AB STEAM Online Auction Supports ABRHS STEAM Clubs

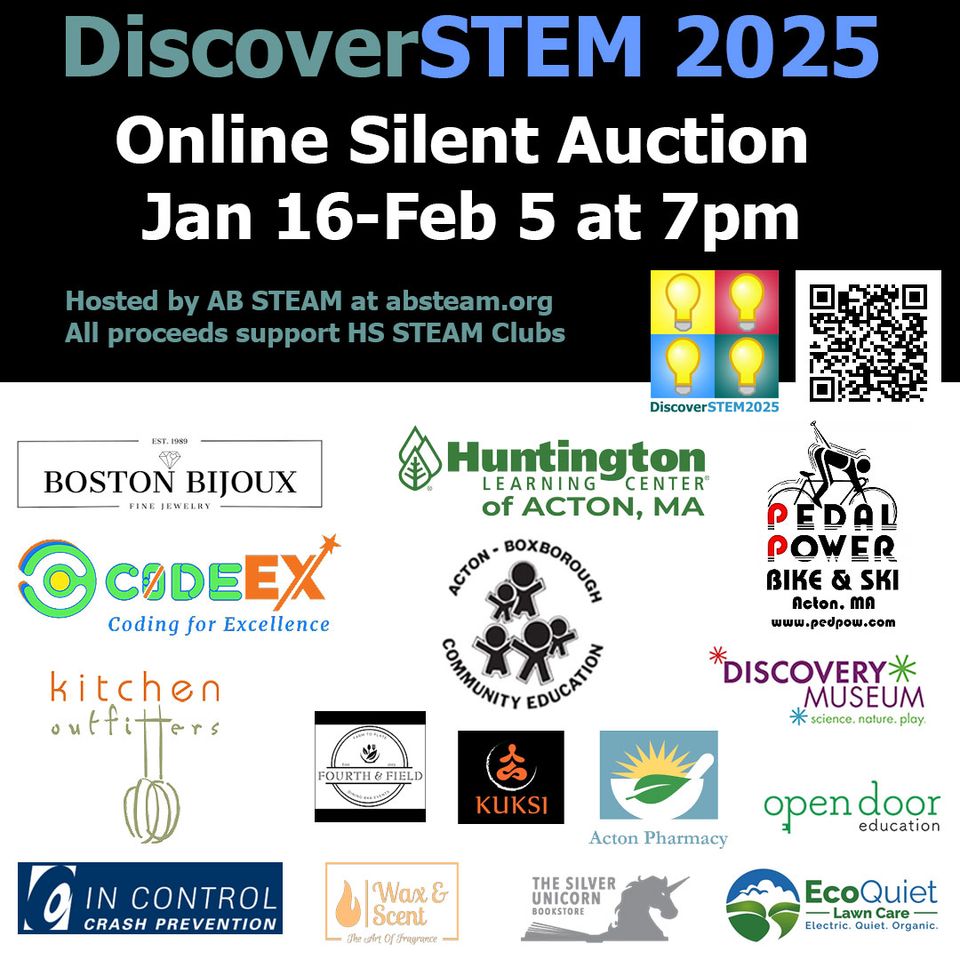

The AB STEAM Online Auction, originally part of DiscoverSTEM 2025, is now LIVE!

Launched on January 16 at the ABRHS Science Fair, the auction runs through 7:00 PM on February 5, closing at the AB STEAM Open House and Hackathon showcase at Danny’s Place. Winning items may be picked up at the Hackathon event. Thanks to the generosity of local Acton-area businesses from Boston Bijoux to Open Door Education, Kitchen Outfitters, Huntington Learning, Pedal Power, Eco Quiet Lawn Care, C0deEX, Silver Unicorn bookstore, The Discovery Museum and more, 100% of auction proceeds benefit ABRHS STEAM Clubs. To learn more and place your bids, scan the QR code on the flyer or check out the auction on the AB STEAM event page at ABSteam.org/events.

AB STEAM (formerly AB PIP STEM) is a volunteer-led nonprofit supporting K–12 Science, Technology, Engineering, Art & Math (STEAM) education in Acton and Boxborough, MA. New volunteers are always welcome and needed to offer fun FREE STEAM events and activities! Visit ABSTEAM.org or contact info@absteam.org.

Launched on January 16 at the ABRHS Science Fair, the auction runs through 7:00 PM on February 5, closing at the AB STEAM Open House and Hackathon showcase at Danny’s Place. Winning items may be picked up at the Hackathon event. Thanks to the generosity of local Acton-area businesses from Boston Bijoux to Open Door Education, Kitchen Outfitters, Huntington Learning, Pedal Power, Eco Quiet Lawn Care, C0deEX, Silver Unicorn bookstore, The Discovery Museum and more, 100% of auction proceeds benefit ABRHS STEAM Clubs. To learn more and place your bids, scan the QR code on the flyer or check out the auction on the AB STEAM event page at ABSteam.org/events.

AB STEAM (formerly AB PIP STEM) is a volunteer-led nonprofit supporting K–12 Science, Technology, Engineering, Art & Math (STEAM) education in Acton and Boxborough, MA. New volunteers are always welcome and needed to offer fun FREE STEAM events and activities! Visit ABSTEAM.org or contact info@absteam.org.