Marlborough, MA — The Highland City Striders, a local non-profit running club, in collaboration with the Friends of Woodlands and Waters, a non-profit organization dedicated to supporting and protecting the Assabet River. Great Meadows, and Oxbow National Wildlife Refuges, announces a new race, the Race for the Refuge, debuting on Sunday September 28, 2025 at the Assabet River National Wildlife Refuge in Sudbury, Mass.

This event aims to raise awareness about the ecological, historical, and recreational value of the Refuge and raise funds to help the staff increase access to and enjoyment of the Refuge for the local community. The race offers a range of events, including a one-mile walk guided by the Friends of Woodlands and Waters, 10K and 30K running races, and 3-hour and 6-hour running events.

“We are thrilled to present this exciting opportunity for people in our community to come and experience the Refuge in this new way,” says Judy Proteau, vice president of the Highland City Striders and co-race director for the Race for the Refuge. “It is one of my favorite places to run and enjoy nature’s beauty and we can’t wait to share it.”

The Highland City Striders is dedicated to promoting health and fitness through the sport of running. The club hosts weekly training runs, camaraderie events, and supports local charities. In 2024, over $19,500 and five truckloads of canned items were donated to the Marlborough and Hudson food pantries in an effort to combat food insecurity.

Race for the Refuge builds on this success and aims to highlight the Refuge and to help the staff fund a volunteer coordinator position who will work to build interpretive programs that increase access to and enjoyment of the Refuge for our community. Funds from the race will also support improvements at these three local National Wildlife Refuges – Assabet River, Great Meadows, and Oxbow – all of which are part of the Eastern Massachusetts National Wildlife Refuge Complex, managed by the U.S. Fish and Wildlife Service.

“One of the goals of our Friends group and the entire refuge system is to create outreach, environmental education, and volunteer opportunities that foster appreciation for the value of healthy habitats that support native plants and wildlife, and to help people connect meaningfully with these protected natural spaces,” says Paula Goodwin, President of the Friends of Woodlands and Waters. “We hope this event will introduce many new people to the natural beauty and remarkable history of the Assabet River National Wildlife Refuge.”

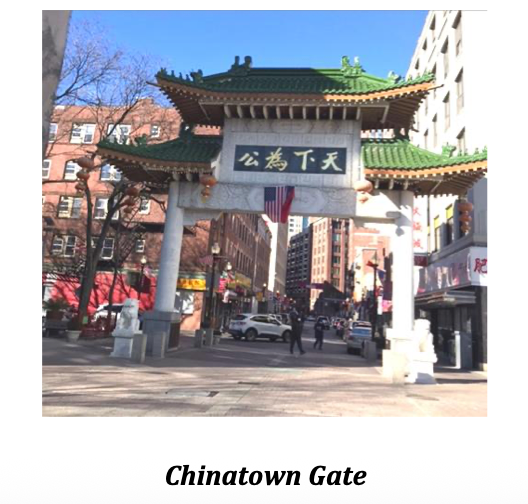

Centuries ago, the Assabet National Wildlife Refuge lands were hunted and fished by Nipmuc Tribes. Later, they were farmed by colonists, intersected by a railroad, and used for military training. Those who join the race will run past military bunkers that were in use when the area was known as the Sudbury Training Annex, which was part of Fort Devens. The U.S. Army transferred the land to the U.S. Fish and Wildlife Service in 2000, establishing the Refuge.

Since then, the Refuge has become home to freshwater wetlands, oak and pine forest, and shrubland that support many types of wildlife, including wading birds, songbirds, raptors, beaver, bobcat, white-tailed deer, and various reptiles and amphibians.

Each registrant will take home a collapsible cup. These are lightweight and easy to pack along on runs and hikes so you can grab a quick drink of water without creating waste. A post race celebration at Clover Road Brewing will include snacks, music, and one free beer ticket for race registrants.

Visit the Race for the Refuge web site (

https://runsignup.com/Race/MA/Sudbury/RaceForTheRefuge) to learn more and register.

Visit the Assabet National Wildlife Refuge web site (

https://www.fws.gov/refuge/assabet-river) to learn more about the refuge.