AYER: UPDATE as of 10/5/22:

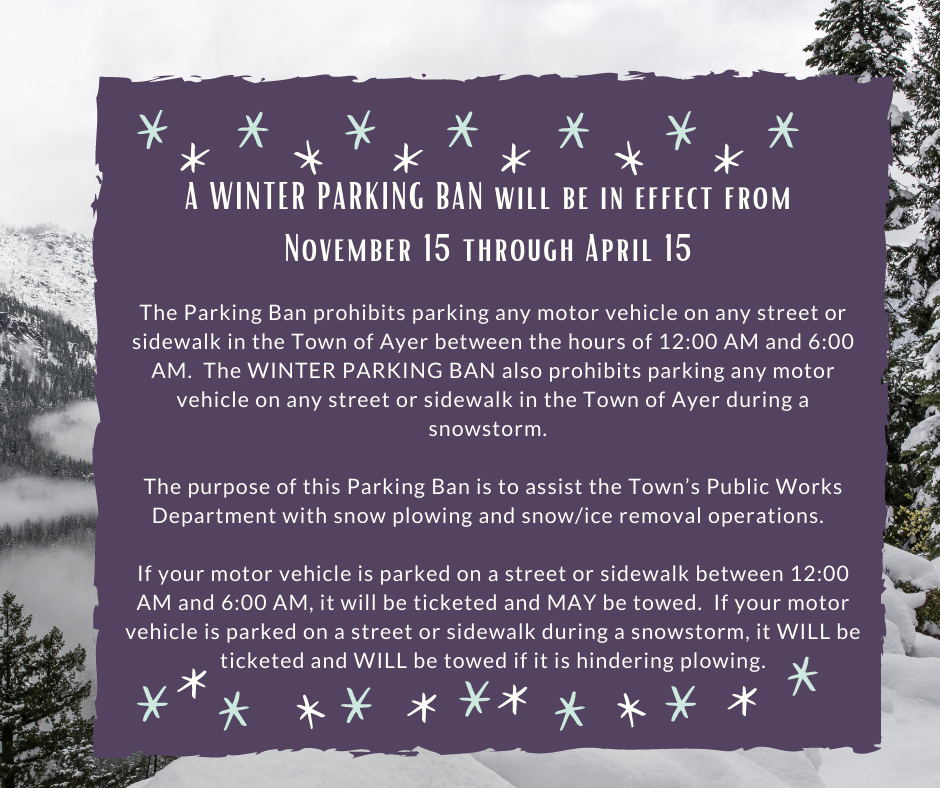

- Central Avenue and Pleasant Street: Due to today’s rainy weather, the final top course pavement on Central Avenue and Pleasant Street is rescheduled for Thursday, October 6th. Detours will be in place during the work, but local traffic will be permitted access. Expect delays. No on-street parking will be allowed during the paving operation (approximately 7am-4pm).

- Westford Road: Paving work associated with Westford Road, from Willow Road to New England Way, will begin on Monday, October 10th. The work will begin with milling the roadway. One-way alternating traffic will be maintained during the Westford Road paving work.

During construction, there will be varying road conditions. Please travel with caution. Police details will be onsite to direct traffic and construction signage will be in place. If you have any questions, please contact the Department of Public Works at (978) 772-8240.

______________________

UPDATE: The Ayer DPW will be installing final top course pavement on the following streets and schedule, weather permitting:

- October 4 - School Street (from Prospect Street to Pirone Park), Page Street

- October 5 - Central Avenue (from Columbia Street to approximately 60 Central Ave), Pleasant Street (from 62 Pleasant Street to Howard Street)

The work consists of installing the top layer of pavement on one-half of the road at a time. Detours will be in place during the work, but local traffic will be permitted access. Expect delays. Please see attached images for anticipated details for Pleasant Street and Central Ave.

No on-street parking will be allowed during the paving operation (approximately 7am-4pm). During construction, there will be varying road conditions. Please travel with caution.

Police details will be onsite to direct traffic and construction signage will be in place.

If you have any questions, please contact the Department of Public Works at 978-772-8240.

___________________

UPDATE: The Ayer DPW is continuing Fall road paving. Work that has been completed and work anticipated during the week of September 26th are outlined below. Note, the work schedule below is subject to change and is dependent on weather.

- Central Avenue (from Columbia Street to approximately 60 Central Ave). Completed: milling, leveling course, asphalt berm, adjusting structures. Anticipated during the week of September 26th: begin sidewalk installation.

- Pleasant Street (from 62 Pleasant Street to Howard Street). Completed: reclaim, binder course. Anticipated during the week of September 26th: asphalt berm, adjusting structures.

- School Street (from Prospect Street to Pirone Park). Completed: milling, berm. Anticipated during the week of September 26th: none.

- Page StreetCompleted: reclaim, binder course. Anticipated during the week of September 26th: asphalt berm, adjusting structures.

- Westford Road (from New England Way to Willow Road). Completed: none. Anticipated during the week of September 26th: none.

Police details will be onsite to direct traffic. There will be varying road conditions, please travel with caution. Traffic flow will be maintained as much as possible. Notification will be given in advance of any required detours. If you have any questions, please contact the Department of Public Works at (978) 772-8240.

___________________

The Ayer DPW will be reclaiming the following streets beginning Monday September 19: Pleasant Street – from 62 Pleasant Street to Howard Street; Page Street – from Groton Harvard Road to East Main Street. The process involves a pavement reclaiming machine that creates a new base material by grinding the existing asphalt and mixing it with the existing base material. The reclaiming is scheduled to begin on Monday, September 19, weather permitting. The work on Pleasant Street is anticipated to take two days and work on Page Street one day.

A detour will be in place on Pleasant Street during work hours, but the road will be open to local traffic. The detour for Pleasant Street will divert traffic to Jackson Street. Please see attached image of the detour. Page Street will be closed to through traffic but open to local traffic.

No on-street parking will be allowed during the reclaiming operation (approximately 7am-4pm). During construction, there will be varying road conditions. Please travel with caution.

Police details will be onsite to direct traffic and construction signage will be in place.

___________________

The Ayer DPW will be conducting road paving this Fall. Work will commence the week of September 12 and is anticipated to continue through the week of October 17. The following streets are included in the paving schedule, in accordance with the Town’s pavement management plan. Central Avenue (from Columbia Street to approximately 60 Central Ave)

Mill and Overlay, Sidewalks Pleasant Street (from 62 Pleasant Street to Howard Street)

Reclamation, Sidewalk School Street (from Prospect Street to Pirone Park)

Mill and Overlay Page Street

Reclamation Westford Road (from New England Way to Willow Road)

Mill and Overlay. The tentative work schedule for the next two weeks is as follows and is subject to change:

Week of 9/12, starting on the 13th:

- Excavating sidewalks on Central Ave followed by Pleasant Street

- Milling on School Street and Central Ave

Week of 9/19:

- Reclaim and pave binder on Pleasant and Page Streets

- Adjusting structures on Central Ave and School Street

- Overlay paving on School Street

Please seek alternative routes. Police details will be onsite to direct traffic.

During construction, there will be varying road conditions. Please travel with caution.

DPW will provide regular construction updates as the work progresses. Traffic flow will be maintained as much as possible. Notification will be given in advance of any required detours.

If you have any questions, please contact the Department of Public Works at (978) 772-8240.